【UK Property Mortgage 2023】The UK, Canada, and Australia are favorite destinations for immigrants from Hong Kong. Since the UK government’s announcement of the “BNO 5+1” visa policy, the number of immigrants to the UK has been steadily increasing. In June 2023, the UK indicated its intent to tighten immigration policies, and the impact on Hong Kong BNO holders remains uncertain. However, for those aiming for long-term residence in the UK, having a home becomes crucial. As a result, many are exploring the option of buying property in the UK or planning for a UK property mortgage. This article will guide you through the process of buying and selling properties in the UK, how to apply for a UK property mortgage, associated costs, and essential precautions.

UK Property Mortgage Application Process

Buying property in the UK has similarities to purchasing property in Hong Kong, but the procedures and regulations differ. Hence, many from Hong Kong hire agents to help with the UK property mortgage application. Yet, some handle everything on their own to save money. Regardless of the type of buyer you are, understanding the UK property mortgage process is essential to avoid unnecessary losses. Generally, UK property mortgages are categorized into first-hand and second-hand, each with distinct processes and timelines.

First-hand UK Property Mortgage

In Hong Kong, whether you’re buying a first-hand or second-hand property, transactions can take place at property agencies. However, in the UK, the first-hand property buying process differs slightly. Buyers usually select their preferred property in a sales gallery and pay an earnest money (not a deposit!) to reserve it. Once the earnest money is paid, the agent issues a Reservation form to the buyer. This form can then be presented to a bank for a UK property mortgage application. Buyers of properties under construction should begin the mortgage application roughly six months before the anticipated move-in date.

Second-hand UK Property Mortgage

The procedure for acquiring second-hand properties is different from that of first-hand ones. Buyers must first obtain a UK property mortgage approval from a bank before officially placing a deposit and signing contracts with the seller. After successful price negotiations, both parties sign a memorandum of sales. Holding this document, the buyer can then formally start the UK property mortgage application. Typically, the entire process, from application to completion, takes about four months. Therefore, ample preparation and planning time is essential to ensure a smooth purchase process.

Regardless of whether one is buying first-hand or second-hand properties in the UK, it’s crucial for buyers to thoroughly understand the UK property mortgage application process and prepare all necessary documents promptly. Moreover, choosing an experienced and reliable mortgage consultant or agent is vital, as they can offer expert advice and help streamline the UK property mortgage application and purchasing procedure.

Where to Obtain a UK Property Mortgage?

To obtain a UK property mortgage, you don’t necessarily need to be in the UK. Local banks like HSBC, Bank of China (as of September 2023, this bank has suspended fixed-rate mortgages), and BEA (Bank of East Asia) all offer UK property mortgages, or can refer you to their UK branches. However, these three banks only provide mortgages for certain UK cities, with a maximum mortgage ratio of 70-80% and a maximum lending period of 30 years. The mortgage terms differ among these banks, so buyers need to compare carefully and choose the UK property mortgage plan that best suits them. Compared to UK banks, applying for a UK property mortgage through local banks might have higher requirements.

Are There Differences in Mortgages for Personal Use and Rental UK Properties?

For properties in the UK meant for personal use versus those for rental, banks may have different mortgage terms and requirements. Generally, the mortgage ratio for rental properties might be lower, and the interest rate may be higher. In Hong Kong, the three major banks have different criteria for the types of properties they provide mortgages for. BEA only accepts “Buy to Let mortgage” (BTL) applications for rental properties in the UK. So, if a buyer intends to use the property for personal residence, they won’t get mortgage approval. In contrast, Bank of China and HSBC offer mortgage applications for both personal residence “Residential mortgage” and rental properties “Buy to Let mortgage”. Hence, before applying for a mortgage, buyers should clarify their needs, whether purchasing for personal residence or rental, and carefully compare the mortgage terms and requirements of different banks.

Overview of UK Property Mortgage Ratio & Duration

The mortgage ratio for UK property applications is slightly higher than in Hong Kong. This is because the HKMA (Hong Kong Monetary Authority) regulations limit local banks to a maximum mortgage ratio of 50-60%, while branches of banks in the UK are more lenient, with most offering up to a 75% mortgage. If you’re considering buying a property in the UK for personal use, you might want to approach the Bank of China for a UK property mortgage, as it offers up to 80%, the highest among the three banks, with a term of up to 30 years.

While the term is stated as 30 years, many UK banks have a mortgage term formula based on the difference between the retirement age and the age of the applicant at the time of the mortgage application. For instance, if the buyer applies for a mortgage at the age of 30 and retires at 60, the maximum mortgage term is 30 years. However, past data indicates that most mortgage applicants opt for a term between 20 to 25 years.

| Bank |

Maximum UK Mortgage Ratio |

Longest UK Mortgage Term |

| HSBC |

75% |

25 years* |

| Bank of China |

Personal: 80%, Rental: 75% |

30 years |

| BEA# |

70% |

25 years^ |

*Whichever is shorter between 30 years and the difference between retirement age and applicant’s age.

^Whichever is shorter between 65 years and the difference between retirement age and applicant’s age.

#Only offers mortgages for rental properties

However, as for which bank is more suitable for your UK property mortgage, it also depends on whether the bank supports local property mortgages. Considering branches, HSBC has the most branches in the UK, while the Bank of China and BEA have fewer branches in the UK.Bank of China UK Branches:

- London

- Birmingham

- Manchester

- Glasgow

BEA UK Branches:

- London

- Birmingham

- Manchester

If you are interested in purchasing a property located outside of these cities, you might need to inquire with your bank before purchasing to see if they offer mortgages for properties in that area.

UK Property Mortgage Application Fees (Updated September 2023)

HSBC Bank

HSBC Bank does not charge any processing or valuation fees. However, they do have varying booking fees depending on the type of mortgage and the initial interest rate. For instance, a 2-year mortgage at a fixed interest rate of 6.74% has no booking fee, while a 2-year mortgage at a fixed interest rate of 6.04% has a booking fee of £1999.

Residential UK Property Mortgage Fees

| Term/Type of UK Mortgage |

Fixed Rate Mortgage |

Variable Rate Mortgage |

| Fixed Fee Saver Plan |

£0 |

Not Listed/Not Applicable |

| Standard Plan |

£999 |

£999 |

| 5-Year Premier Standard Plan |

£1499 |

Not Listed/Not Applicable |

*Applicable to 2 / 3 / 5 / 10 year payments

Rental UK Property Mortgage Fees

| Term/Type of UK Mortgage |

Fixed Rate Mortgage |

Variable Rate Mortgage |

| Fixed Fee Saver Buy To Let Plan |

£0 |

£0 |

| 5-Year Premier Standard Plan |

£1999 |

£1999 |

*Applicable to 2 / 5 year payments

Source:HSBC Bank (UK) Mortgage Fee Schedule

Bank of China (As of September 2023, this bank has suspended fixed-rate mortgages)

The Bank of China charges a telegraphic transfer fee, arrangement fee, booking fee, valuation fee, and deed discharge fee for each UK property mortgage. Furthermore, if early repayment is required, there might be an early repayment charge (ERC). All fees are non-refundable, regardless of whether the mortgage is completed or not.

BEA (Bank of East Asia) UK Property Mortgage Application Fees

| Telegraphic Transfer Fee |

£35 |

| Arrangement Fee |

£1295 / £2495 / 0.5% of loan amount |

| Valuation Fee |

Depends on property value |

| Booking Fee |

£299 |

| Deed Discharge Fee |

£95 (payable upon completion) |

| Early Repayment Charge (ERC) |

Applicable only if the full amount is repaid in the first year, 1% of the loan amount |

Source:Bank of China (UK) Mortgage Fee Schedule

Bank of East Asia

Bank of East Asia charges an application fee, arrangement fee, and valuation fee for each UK property mortgage. The application fee is £300, which is the highest among the three banks, but the arrangement fee starts as low as £600, making it cheaper than the Bank of China. Additionally, an early repayment charge (ERC) may apply if you decide to repay the mortgage earlier. All fees are non-refundable, whether the mortgage is completed or not.

Bank of East Asia UK Property Mortgage Application Fees

| Application Fee |

£300 |

| Arrangement Fee |

0.5% of loan amount / Minimum £600 |

| Valuation Fee |

0.1-0.15% of property value |

UK Property Mortgage Application Criteria and Stress Test

What are the criteria for applying for a UK property mortgage? Generally, for Hongkongers applying for a UK property mortgage, up to 70% of the property’s value can be mortgaged, with most mortgage terms being 20 years. Most banks only accept payments in GBP for their UK mortgage plans, which indirectly exposes Hong Kong property owners to exchange rate risks. At the same time, UK banks will conduct a stress test on the buyer at an increased interest rate of 2%, ensuring that monthly payments do not exceed 50% of their income. Different banks have the following annual income requirements for applicants (only basic salary is considered, without accounting for bonuses and double pay):

| Bank |

City |

Annual Income Requirement |

Type |

| HSBC |

UK and Scotland |

Individual: £50,000 Company: £75,000 |

Residential/Rental |

| Bank of China |

London, Birmingham, Manchester |

N/A |

Residential/Rental |

| Bank of East Asia |

London, Birmingham, Manchester |

£72,000 |

Rental |

UK Mortgage Threshold: How is the Stress Test Calculated?

Buyers applying for a UK property mortgage through a local bank must pass a stress test. With the GBP exchange rate considered by the Hong Kong Monetary Authority as a risk for overseas property investment, it becomes harder for buyers applying through local banks to pass this test. As a result, some buyers opt for mortgages from UK local banks, where the purchasing conditions are more lenient than in Hong Kong.

However, UK banks have stricter income requirements for applicants than Hong Kong, as they only consider net income, excluding all bonuses, double pay, and other incomes. Mortgage applications through UK banks mainly depend on the payment-to-income ratio. UK banks may increase mortgage interest rates to offset risks for higher payment-to-income ratios, with the upper limit being around 60-70%. However, surpassing a 60% ratio is challenging. Additionally, during the approval process, UK banks will also consider the applicant’s expenses and debt situation. Buyers can review their spending situation when applying for a mortgage. UK banks, however, will not review credit databases, commonly referred to as TU.

Types of UK Property Mortgages and Major Bank Comparison

UK property mortgages, like in Hong Kong, come in two types: fixed-rate and tracker mortgages. Repayment plans offer interest-only or interest and principal repayments. According to market statistics, one-third of UK property owners opt for interest-only payments to complete their mortgage repayments.

Fixed Rate Mortgage

With a fixed-rate mortgage, buyers can ensure their payments won’t fluctuate with the Bank of England’s interest rate for a certain period, typically two to five years. Banks initially charge an “arrangement fee” and a “booking fee”. At the end of each fixed-rate period, these fees must be paid again. After three years of a fixed-rate mortgage, buyers can choose a new fixed-rate mortgage plan or opt for a tracker mortgage, redefining their future payment mode.

Tracker Mortgage

The interest rate for a tracker mortgage is determined by a reference rate plus the Bank of England’s base rate. When the Bank of England raises interest rates, the base rate will adjust, and the mortgage interest rate will increase accordingly. So, with a tracker mortgage, the interest rate can either increase or decrease based on economic conditions, leading to variable payments.

Interest-only Repayment

Regardless of choosing a fixed-rate or tracker mortgage, buyers can also opt for “interest-only” repayment. This option targets rental properties with an investment component, and the mortgage ratio must be tightened by 5% compared to the original stipulation. Buyers only need to repay the monthly interest, and some owners choose “interest-only” to maintain sufficient cash flow.

Comparison of Major Banks’ UK Property Mortgages: Which One is Right for You?

If you are considering a fixed-rate mortgage, your only option is HSBC, as it is currently the only major bank in Hong Kong offering a “fixed-rate mortgage” option (as of September 2023, Bank of China has suspended this service). HSBC’s fixed-rate mortgage terms are two, five, and ten years, with varying loan-to-value ratios. Choosing different “initial fixed-rate terms” and “fixed interest rates” will impact the “booking fee”. In simple terms, if the “initial fixed rate” is lower, the “booking fee” will be higher and vice versa. The fixed interest rate for residential properties ranges between 5.54% and 6.63%, while for rental properties, it’s between 5.74% and 6.79%.

Regarding the penalty period for fixed-rate mortgages, if there is a partial repayment or redemption during the fixed-rate period, there will be penalties. HSBC allows buyers to repay up to 10% of the remaining loan amount annually without penalties during the fixed-rate period. If this 10% threshold is exceeded, a penalty of 1-5% will be charged. Additionally, an administrative fee will be charged by the bank during redemption. The Bank of China stipulates that a penalty of 1% of the loan amount must be paid for early repayment within the first three years.

As for tracker mortgages, only HSBC among the three banks does not offer a full-term tracker mortgage. The interest rate for the first two years will vary based on the loan-to-value ratio and the booking fee. Though it appears fixed at first glance, these rates will fluctuate according to the Bank of England’s base rate. After two years, the interest rate for residential UK property mortgages is 6.99%, while for rental UK property mortgages, it’s 7.6%. These UK property mortgage rates will also vary with the Bank of England’s base rate.

Moreover, both the Bank of East Asia and the Bank of China offer full-term tracker mortgages. Their rates will adjust based on the loan amount and the loan-to-value ratio. For instance, the Bank of China’s maximum loan amount is £5,000,000, with its residential property’s full-term rate ranging between 3.39% + the Bank of England’s base rate and 3.99% + the Bank of England’s base rate.

Concerning the penalty period for tracker mortgages, the Bank of China mandates that a penalty of 1% of the loan amount must be paid for early repayments within the first three years. HSBC doesn’t offer any advantages for early repayment; any early repayment or redemption will incur a penalty of 1-5%. The Bank of East Asia charges £150 for partial repayments or early redemption, with an additional £100 administrative fee for full early redemptions.

If you are inclined to choose an interest-only plan without repaying the principal, only the Bank of China offers this option. However, note that this plan is only applicable for rental properties intended for investment purposes, and the loan-to-value ratio will be 5% lower than regular plans.

Table comparing the UK property mortgage plans of the three banks:

| Item / Bank |

HSBC |

Bank of China |

Bank of East Asia |

| Offers fixed-rate mortgage |

✔️ (Two-year, three-year, five-year, ten-year terms) |

❌ (Suspended in 2023) |

❌ |

| Booking fee for fixed-rate mortgage |

Varying based on “initial fixed-rate term” and fixed interest rate |

– |

– |

| Range of fixed-rate mortgage interest rates |

Residential: 5.54%-6.63%; Rental: 5.74%-6.79% |

– |

– |

| Penalty for early repayment of fixed-rate mortgage |

Can repay up to 10% of the remaining loan amount annually without penalty; a 1-5% penalty is charged for exceeding this limit |

1% penalty for repayment within the first three years |

– |

| Offers variable rate mortgages for the entire term |

❌ (Variable rate for the first two years only) |

✔️ |

✔️ |

| Variable rate mortgage interest range |

Primary Residence: 5.84%-5.94%; Rental: 6.19%-6.39% |

Primary Residence: 3.39%+base to 3.99%+base; Rental: 4.09%+base to 4.69%+base |

Depends on the loan amount |

| Penalty for early repayment of variable rate mortgage |

1-5% penalty for early repayment |

1% penalty for repayment within the first three years |

Early redemption or partial repayment: £150; Full early redemption: £100 administration fee |

| Offers interest-only repayment plan |

❌ |

✔️ (Only applicable to investment rental properties) |

❌ |

UK Property Purchase Process

Step One in UK Property Purchase: Property Search

Similar to Hong Kong, the UK also has off-plan property sales. However, in the UK, there are no specific key dates, only estimated completion dates based on the season. Overseas or UK real estate agents often hold exhibitions in Hong Kong to promote UK properties. Some of these properties are off-plan, while others are existing properties. Existing properties are more popular in the market because they are immediately available for occupancy after purchase, thus, they tend to have higher prices.

Due to pandemic restrictions, it might not be possible for Hong Kong residents to visit the UK in person. However, interested investors need not worry. Exhibitions often provide sample units or models for reference. If one is considering purchasing a second-hand UK property, buyers can browse UK property websites to view photos or take virtual reality (VR) tours of the property. Of course, if needed, you can also request agents to conduct real-time virtual property tours to view the actual condition of the property.

Step Two in UK Property Purchase: Sign the “Preliminary Sales Agreement” and Pay a Deposit

If a buyer has chosen their desired UK property, they need to sign a “Preliminary Sales Agreement” with the owner or developer and pay a deposit, typically ranging from £1,000 to £5,000. If purchasing a second-hand UK property, buyers can try to negotiate the price with the seller. Once both parties agree on the price, they can sign a “Sales Memorandum”. Subsequently, the buyer can appoint a solicitor or agent to proceed with the sales formalities. Of course, those planning to purchase a second-hand UK property can also hire a property surveyor to produce a detailed structural and architectural report.

UK Property Purchase Process Step Three: Apply for a UK Property Mortgage

After successfully signing the “Preliminary Sales Agreement” and paying the deposit, you can immediately apply for a UK property mortgage. Depending on the type of property, such as primary residence/rental/new property/second-hand property, the mortgage procedures and costs may differ. For details, refer to the earlier sections of this article.

UK Property Purchase Process Step Four: Sign the Official Sales Contract and Pay the Down Payment/Deposit

Once the buyer has successfully obtained approval for the UK property mortgage, they can make the down payment to the developer. Simultaneously, if it’s a second-hand UK property, the buyer can pay the deposit. The down payment for new UK properties typically ranges between 10% to 30% of the property price, and some buyers may be required to pay before applying for the mortgage. For second-hand UK properties, the deposit is usually around 10% of the property price, payable to the owner upon contract signing. If the buyer defaults, the deposit is non-refundable.

UK Property Purchase Process Step Five: Property Handover

Developers may request owners who have purchased off-plan properties to pay a portion of the property price 6 months after signing the contract. Therefore, buyers should pay attention to the payment schedule specified in the sales contract. Once the project is completed, the solicitor will notify the buyer to inspect the property and inform them of the exact handover date. On the day of the handover, the bank will transfer all mortgage loans to the developer, completing the entire UK property purchase process.

Additional Information: What are the ongoing expenses after purchasing a UK property?

The table below lists the regular expenses for UK property owners. Prices may vary due to local policies. For the latest information, please contact UK property agents!

| Council Tax |

Annual council tax payments are typically between £1,500 to £2,000 for a general property. If the property is rented out, the council tax is paid by the tenant. |

| Ground Rent |

Property buyers in the UK are required to pay an annual ground rent to the landlord, typically around £400. |

| Income Tax |

If the UK property is purchased for rental purposes, the buyer must pay income tax based on the rental income. Non-UK citizens pay income tax at rates ranging from 20% to 45% of their annual income, while UK citizens have a tax-free allowance below £12,500. |

| Property Management Fee |

If the UK property is purchased for rental purposes, a management fee is payable to the property management company, typically about 10% of the monthly rental income. |

| Building Insurance |

Buyers of new UK properties receive insurance coverage for 10 years; buyers of second-hand UK properties need to purchase insurance, with costs ranging from £100 to £500. |

Key Points to Note When Applying for a UK Property Mortgage

- Prepare necessary documents: UK mortgage applicants need to provide evidence of British Citizen or BNO Visa identity, proof of address, three months of bank statements, and proof of down payment funds. It’s important to note that different banks have varying requirements for document validity. For instance, BEA (Bank of East Asia) requires buyers to provide two years of tax bills, six months of salary slips, and statements; HSBC only requires one year of tax bills, but the rest of the requirements are similar to BEA.

| |

HSBC |

BEA (Bank of East Asia) |

Bank of China |

| Tax Bill |

1 Year |

2 Years |

Latest |

| Salary Slip |

6 Months |

6 Months |

3 Months |

| Monthly Statement |

6 Months |

6 Months |

3 Months |

- Allocate Time for Opening a GBP Account: As a popular migration destination, many Hongkongers plan to open offshore accounts to move their assets out of Hong Kong. To avoid affecting the mortgage application timeline, it’s advisable to open a GBP account well before applying for the mortgage.

- Be Aware of Additional Charges: If you plan to transfer GBP from Hong Kong to a UK account monthly, besides considering foreign exchange risks, you should also be aware of potential transaction fees. For instance, with HSBC, if you have an Advanced or Premium account in the UK, you can perform global online funds transfers. However, for standard accounts, electronic remittance methods may incur additional fees.

Pitfalls in UK Property Transactions

Pitfall One: Unfinished UK Property Projects

Just like in Hong Kong, the UK also has off-plan properties. However, UK off-plan properties do not have a “key date,” only an estimated completion date specified by year and quarter. This flexibility often results in projects being “left unfinished” as developers delay handovers significantly. UK off-plan property buyers should note that contracts only offer a Long Stop Date for protection, typically 12-18 months after the expected completion date. Developers can hand over the property anytime within this period without any compensation to the buyer. Hence, buyers should be prepared for flexible timelines.

Pitfall Two: Credibility of Agents/Developers

Often, developers use deposits from off-plan buyers as funding for construction projects. Some smaller developers might pre-sell without official government approval. If the developer faces liquidity problems, prospective buyers might bear the risks. Therefore, it’s recommended to choose reputable, large-scale developers.

Moreover, UK property buyers should be aware that estate agents selling UK properties in Hong Kong are not regulated and do not hold any licenses. Hence, buyers should research and verify the background and reputation of the agent before engaging.

Pitfall Three: Return Guarantees

No investment comes with guaranteed returns. UK property buyers shouldn’t be misled by such claims. Even if developers genuinely offer rental guarantees, they might outsource rental services to rental companies. If these companies go bankrupt, the buyer has no recourse. Additionally, many rental agreements might not cover certain taxes payable by the buyer. Hence, if buyers plan to hire rental companies for their UK properties, they should opt for those regulated by the government.

FAQs Related to UK Property Mortgages

- Under what circumstances can a mortgage be rejected?

Each bank has different approval criteria. Some might not approve mortgages for older properties, properties with a small area, or those with structural issues. Especially renovated old buildings have had mortgage rejections in the past. For instance, BEA (Bank of East Asia) clearly states they won’t approve mortgages for buyers who own more than three UK properties and won’t consider properties with high ground rents or buildings over 18 meters without external wall structures. HSBC, given the impact of the COVID-19 pandemic, has stricter requirements for high-ratio mortgages and currently won’t approve 85% mortgages.

- Can Hongkongers get up to 90% mortgage for UK properties?

Generally, when Hongkongers apply for a mortgage for UK properties, they can get up to 70% of the property value, with most mortgage terms lasting for 20 years. Most banks’ UK property mortgage plans require payments in GBP, indirectly exposing Hong Kong owners to currency exchange risks.

- What are Freehold and Leasehold?

Freehold means the property is owned permanently by the owner. The owner can choose whether to sell the land along with the property. Naturally, properties with freehold status are valued higher. Leasehold properties typically have lease terms of either 90 or 120 years, requiring annual ground rent and maintenance fees. When the lease term expires, there’s a risk of the land being reclaimed.

- What is the Help to Buy Mortgage Scheme?

The “Help to Buy” scheme allows UK citizens and those with legal residency visas to purchase their first home by paying just 5% down payment. The UK government provides a housing loan ranging from 15% to 40%. For the first five years, buyers don’t have to pay interest, while the remaining loan amount can be mortgaged through a bank. This scheme is only applicable for first-time buyers or those changing homes, with a property price cap of £600,000.

Being a global financial center, the UK witnesses a high influx and outflux of professionals from various countries. Additionally, the UK’s “BNO 5+1” immigration visa policy has led many Hongkongers to reconsider immigration, inevitably increasing the demand for housing in the UK. This rise in demand will likely result in property prices steadily increasing. Regardless of whether it’s for personal use or investment, buying UK properties seems to be a good choice.

After this comprehensive guide, you should have a deeper understanding of the process of buying UK properties and the procedures for applying for UK property mortgages. However, the information provided might change based on UK policies and market factors. If you’d like to stay updated with the latest UK property information, please leave your contact details, and we’ll proactively provide you with the latest updates!

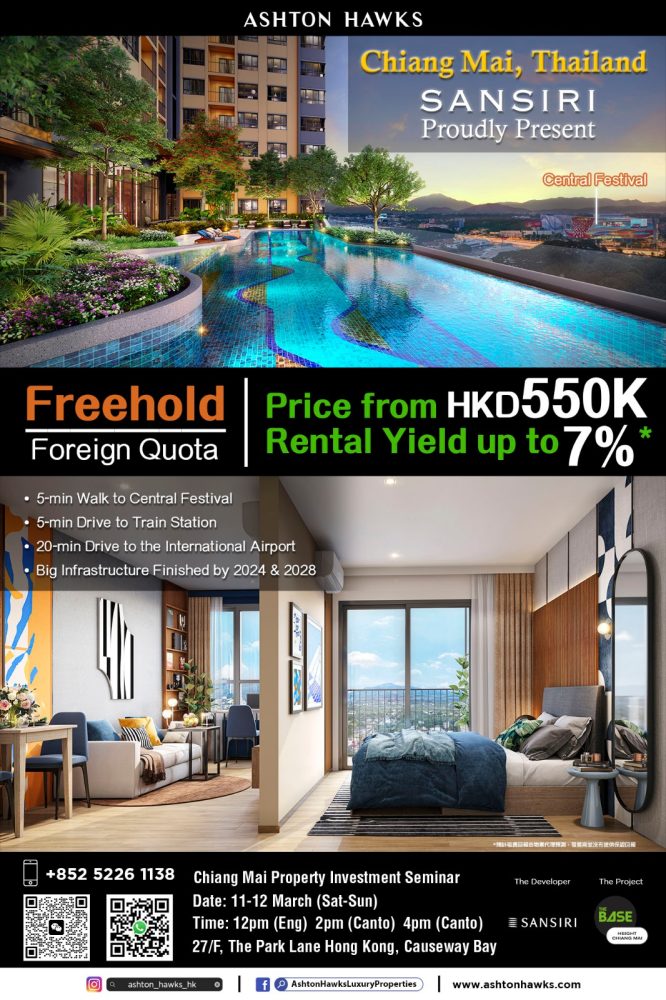

Ashton Hawks was founded by a group of seasoned property investment experts. We offer professional real estate consultancy services to investors interested in overseas property investments. We also provide diversified property investment portfolios for reference, ensuring our esteemed clients are always in the loop and can seize every opportunity.

Disclaimer:The information, text, photos contained herein are provided solely for the convenience of interested parties and no warranty or representation as to their accuracy, correctness or completeness is made by Ashton Hawks or the sellers, none of whom shall have any liability or obligation with respect thereto. These offerings are made subject to contract, correction of errors, omissions, prior sales, change of price or terms or withdrawal from the market without notice. Information provided is for reference only and does not constitute all or any part of a contract. Ashton Hawks and its representatives work exclusively in relation to properties outside Hong Kong and are not required to be nor are licensed under the Estate Agents Ordinance (Cap. 511 of the Laws of Hong Kong) to deal with properties situated in Hong Kong. Digital illustrations are indicative only. *Rental yield is projected by the agency and not guaranteed by the developer.